Merchant Console vTerminal

You can process many types of transactions and lookup currency exchange rates from the Virtual Terminal (or vTerminal) tab. There will be sub-tabs for each action including:

- Sale -For credit/debit card sales.

- Check -For ACH sales.

- Void -For voiding pending credit/debit card transactions.

- Credit card credits (refunds).

- CheckCredit -For ACH credits refunds.

- AuthOnly- For authorization only (queued) credit/debit card transactions.

- PostAuth- For post authorization (offline) transactions.

- Rate Lookup- To lookup the current exchange rate between currencies.

You will only see the tabs for the kinds of transactions you are set up to process. For example, if you are not set up with a check processor then you will not see the Check or CheckCredit tabs and if you are not set up with multi-currency processing you will not see the RateLookup tab.

Please Note: The tables below denote the required fields for each transaction type. That being said, USAePay recommends you enter all of the fields in each form. This ensures you are charged the processing rate originally quoted by your merchant service bank.

At the bottom of each form are the email receipt options (these receipt options do NOT have an effect on processing rates). Click the pale blue square to the right of each email field to expand the email options and include a drop down menu which will provide you will multiple email receipt formatting options. To change or create new email receipt formats, visit the Receipts section of the Settings tab of your console.

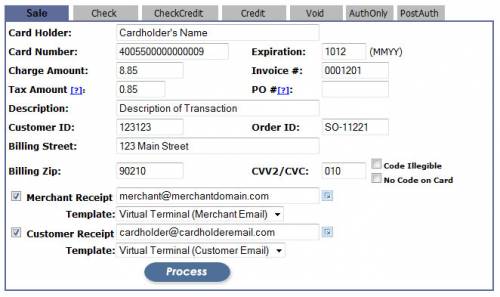

Sale

The Sale tab in the vTerminal is to process credit/debit card sales. To charge a customer's credit card, enter the required information into the Sale form. As stated above, to ensure that you are charged the rate you were originally quoted by your merchant service bank, USAePay recommends you enter all the fields (with the exception of the optional email receipt fields). If any of the fields are left blank, you could possibly be charged a higher rate.

The Sale tab contains the following fields. Once you have filled in all of the required/desired fields, click the 'Process' button to submit the form. One of the following transaction results will appear: Approved, Decline, or Error. Click here for more transaction result information.

Required fields are in bold and fields required for only corporate cards are marked ^.

| Field | Description | Character Limit |

|---|---|---|

| Card Holder | The customer's name as it appears on the card. | 60 |

| Card Number | The 13-16 digit number as it appears on the card (enter without dashes or spaces between numbers). | 19 |

| Expiration | The date on which card is set to expire (enter in MMYY format). | 5 |

| Currency | Choose the customer's native currency from drop-down menu-- this option is available only to merchants who are enabled for multi-currency processing (If customer's native currency is not available email customersupport@usaepay.com for more information). | NA |

| Charge Amount | The total amount you want to charge the customer (including tax). | 15 |

| Invoice # | The merchant assigned tracking number for recording purposes. | 10 |

| Tax Amount ^ | The portion of the total charge amount that is tax. For example, if you have an $8.00 order with 0.85 tax for a total of $8.85, you would enter 8.85 in the Charge Amount field and 0.85 in the Tax Amount field. | 15 |

| PO # ^ | The purchase order number (required for corporate credit cards). | 15 |

| Description | A brief description of goods or services purchased. | 50 |

| Customer ID | The merchant assigned customer number for recording purposes (entering a number here will NOT create a new customer in the Customer Database). | 20 |

| Order ID | The merchant assigned order number for recording purposes. | 20 |

| Billing Street | The street address matching the billing address of the customer's card (used for fraud prevention purposes with AVS). | 50 |

| Billing Postal Code | The zip or postal code matching the billing address of the customer's card (used for fraud prevention purposes with AVS). | 15 |

| CVV2/CVC | The 3 digit security code located on the back of Visa and MasterCards or the 4 digit security code located on the front of American Express Cards. If the code is not visible, or is not on the card, check one of the boxes on the right. | 4 |

| Merchant Receipt | If checked, an email receipt is sent to the merchant email address entered in the field provided. Multiple email addresses may be entered if separated by commas. To select a custom receipt, click on the arrow icon on the right and select the correct receipt from the drop-down menu. | 50 |

| Customer Receipt | If checked, an email receipt is sent to the customer email address entered in the field provided. Multiple email addresses may be entered if separated by commas. To select a custom receipt, click on the arrow icon on the right and select the correct receipt from the drop-down menu. | 50 |

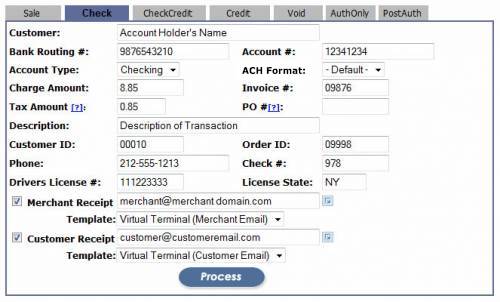

Check

The Check sub-tab allows you to charge check transactions electronically. To deduct the amount of a sale from a customer's checking account, enter the required information into the check form. As stated above, to ensure that you are charged the rate you were originally quoted by your merchant service bank, USAePay recommends you enter all the fields (with the exception of the optional email receipt fields). If any of the fields are left blank, you could possibly be charged a higher rate. The account holder's driver's license number and state of issue are especially helpful because they help to verify the identity of the checking account holder and minimize fraud.

The Check tab contains the following fields. Once you have filled in all of the required/desired fields, click the 'Process' button to submit the form. One of the following transaction results will appear: Approved, Decline, or Error. Click here for more transaction result information.

Required fields are in bold.

| Field | Description | Character Limit |

|---|---|---|

| Customer | The customer's name as it appears on the checking account. | 60 |

| Bank Routing Number | The routing number for customer's bank - appears on customer's check as the first nine digits at the bottom of the check. | 9 |

| Account Number | The customer's checking account number - also appears at the bottom of the check, to the right of the bank routing number. | 19 |

| Account Type | Choose the customer's type of bank account from drop-down menu- options are: Checking & Savings. | NA |

| ACH Format | Choose the ach format you would like to use from drop-down menu-- this option is available only to merchants who have a processor that supports it. Click here for more information. | NA |

| Charge Amount | The total amount you want to charge the customer (including tax). | 15 |

| Invoice # | The merchant assigned tracking number for recording purposes. | 10 |

| Tax Amount | The portion of the total 'Charge Amount' that is tax. For example, if you have an $8.00 order with 0.85 tax for a total of $8.85, you would enter 8.85 in the Charge Amount field and 0.85 in the Tax Amount field. | 15 |

| PO # | The purchase order number. | 15 |

| Description | A brief description of goods or services purchased. | 50 |

| Customer ID | The merchant assigned customer number for recording purposes (entering a number here will NOT create a new customer in the Customer Database). | 20 |

| Order ID | The merchant assigned order number for recording purposes. | 20 |

| Phone | The customer's telephone number in case of error. | 40 |

| Check Number | The check number to be used for tracking purposes - appears at bottom of customer's check to the right of the account number | 11 |

| Driver's License Number | The customer's driver's license number - for identification verification purposes. | 15 |

| License State | The customer's driver's license state of issue - must be used in conjunction to the driver's license number, for identification verification purposes | 2 |

| Merchant Receipt | If checked, an email receipt is sent to the merchant email address entered in the field provided. Multiple email addresses may be entered if separated by commas. To select a custom receipt, click on the arrow icon on the right and select the correct receipt from the drop-down menu. | 50 |

| Customer Receipt | If checked, an email receipt is sent to the customer email address entered in the field provided. Multiple email addresses may be entered if separated by commas. To select a custom receipt, click on the arrow icon on the right and select the correct receipt from the drop-down menu. | 50 |

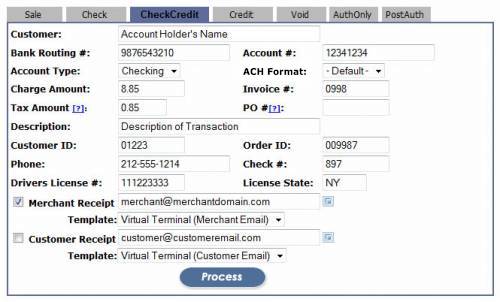

CheckCredit

If you need to refund a customer's bank account, the CheckCredit sub-tab allows you to transfer money electronically to your customer. To deposit the amount of a credit to a customer's checking account, enter the required information into the CheckCredit form. , including the fields listed below. The account holder's driver's license number and state of issue are especially helpful because they help to verify the identity of the checking account holder and minimize fraud.

The CheckCredit tab contains the following fields. Once you have filled in all of the required/desired fields, click the 'Process' button to submit the form. One of the following transaction results will appear: Approved or Error. Click here for more transaction result information.

Required fields are in bold.

| Field | Description | Character Limit |

|---|---|---|

| Customer | The customer's name as it appears on the checking account. | 60 |

| Bank Routing Number | The routing number for customer's bank - appears on customer's check as the first nine digits at the bottom of the check. | 9 |

| Account Number | The customer's checking account number - also appears at the bottom of the check, to the right of the bank routing number. | 19 |

| Account Type | Choose the customer's type of bank account from drop-down menu- options are: Checking & Savings. | NA |

| ACH Format | Choose the ach format you would like to use from drop-down menu-- this option is available only to merchants who have a processor that supports it. Click here for more information. | NA |

| Charge Amount | The total amount you want to deposit into the customer's account (including tax). | 15 |

| Invoice # | The merchant assigned tracking number for recording purposes. | 10 |

| Tax Amount | The portion of the total 'Charge Amount' that is tax. For example, if you have an $8.00 order with 0.85 tax for a total of $8.85, you would enter 8.85 in the Charge Amount field and 0.85 in the Tax Amount field. | 15 |

| PO # | The purchase order number. | 15 |

| Description | A brief description of the refund. | 50 |

| Customer ID | The merchant assigned customer number for recording purposes (entering a number here will NOT create a new customer in the Customer Database). | 20 |

| Order ID | The merchant assigned order number for recording purposes. | 20 |

| Phone | The customer's telephone number in case of error. | 40 |

| Check Number | The check number to be used for tracking purposes - appears at bottom of customer's check to the right of the account number | 11 |

| Driver's License Number | The customer's driver's license number - for identification verification purposes. | 15 |

| License State | The customer's driver's license state of issue - must be used in conjunction to the driver's license number, for identification verification purposes. | 2 |

| Merchant Receipt | If checked, an email receipt is sent to the merchant email address entered in the field provided. Multiple email addresses may be entered if separated by commas. To select a custom receipt, click on the arrow icon on the right and select the correct receipt from the drop-down menu. | 50 |

| Customer Receipt | If checked, an email receipt is sent to the customer email address entered in the field provided. Multiple email addresses may be entered if separated by commas. To select a custom receipt, click on the arrow icon on the right and select the correct receipt from the drop-down menu. | 50 |

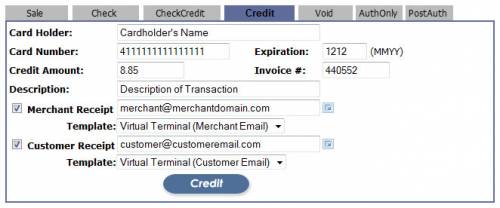

Credit

If you need to refund a customer's credit/debit card, the Credit sub-tab allows you to refund money back to your customer after a transaction has been settled. The Credit form is very similar to the Sale form except that it is more simplified. You will issue a credit when a refund needs to be issued for a credit card transaction in a batch that has already been settled. If you would like to issue a refund for a transaction that has not yet been settled, the Void tab should be used instead. You may also issue a credit for back to a card that has not yet been charged if necessary. This is known as an 'Open Credit' and is also processed on this same tab. Please note: Merchants can only process open credits if their processor allows it. If you do not have the full card number, you can process a credit through the Batch Manager or you can process a Quick Credit through the Transaction Details.

The Credit tab contains the following fields. Once you have filled in all of the required/desired fields, click the 'Credit' button to submit the form. One of the following transaction results will appear: Approved or Error. Click here for more transaction result information.

Required fields are in bold.

| Field | Description | Character Limit |

|---|---|---|

| Card Holder | The customer's name as it appears on the card. | 60 |

| Card Number | The 13-16 digit number as it appears on the card (enter without dashes or spaces between numbers). | 19 |

| Expiration | The date on which card is set to expire (enter in MMYY format). | 5 |

| Credit Amount | The total amount you want to transfer back to the customer's card (including tax). | 15 |

| Invoice # | The merchant assigned tracking number for recording purposes. | 10 |

| Description | A brief description of the refund. | 50 |

| Merchant Receipt | If checked, an email receipt is sent to the merchant email address entered in the field provided. Multiple email addresses may be entered if separated by commas. To select a custom receipt, click on the arrow icon on the right and select the correct receipt from the drop-down menu. | 50 |

| Customer Receipt | If checked, an email receipt is sent to the customer email address entered in the field provided. Multiple email addresses may be entered if separated by commas. To select a custom receipt, click on the arrow icon on the right and select the correct receipt from the drop-down menu. | 50 |

Void

A Void may only be issued for a transaction in the current (open) batch. To refund a sale in a batch that has already been settled, you must use the Credit tab. If you do not have the full card number, you can process a void through the Batch Manager or through the Transaction Details.

The Void tab contains the following fields. Once you have filled in all of the fields, click the 'Void' button to submit the form. One of the following transaction results will appear: Approved or Error. Click here for more transaction result information.

Required fields are in bold.

| Field | Description | Character Limit |

|---|---|---|

| Card Number | The 13-16 digit number as it appears on the card (enter without dashes or spaces between numbers). | 19 |

| Void Amount | The total amount of transaction to be voided. This MUST be equal to the original transaction amount. | 15 |

| Authorization Code | The authorization code - this code was assigned to the transaction by the gateway when it was submitted to the system for processing. | 15 |

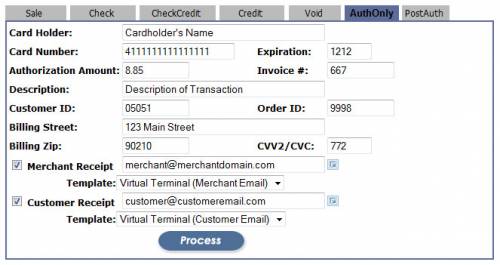

AuthOnly

The AuthOnly form is used to validate and reserve funds on a credit card without charging the customer. It cannot be used for ACH. The AuthOnly transaction is used in various situations. For example, it can used to reserve a deposit that may be returned later (like for a rental car or hotel room) or it can also be used to authorize an original amount that will increase later (like when a restaurant runs an initial charge and adds the tip after you have signed the receipt). An AuthOnly transaction will reserve the validated funds for approximately ten days, depending on your merchant service bank (some banks will reserve these funds for up to 30 days). The AuthOnly will generate an 'Authorization Code' which can be used at any time during the ten days to charge the card and complete the transaction.

The AuthOnly sub-tab contains the fields in the table below. As stated above, to ensure that you are charged the rate you were originally quoted by your merchant service bank, USAePay recommends you enter all the fields (with the exception of the optional email receipt fields). If any of the fields are left blank, you could possibly be charged a higher rate. Once you have filled in all of the required/desired fields, click the 'Process' button to submit the form to the gateway. One of the following transaction results will appear: Approved, Decline, or Error. Click here for more transaction result information.

Approved transactions are sent to the Queued Transactions. To complete your authonly transaction, go to the Queued Transactions screen in your Batch Manager, verify that the final amount of the transaction is showing in the 'Amount' field (if it is not correct, click into that field and raise or lower the amount as needed by typing in the correct amount), check the box in the 'Post' column on the far right hand side of the row, and click the 'Process Changes' button at the bottom of the screen. If you do not complete the transaction within the allowed time period, the Authorization Code will expire, and the customer will not be charged. An AuthOnly cannot be voided or credited since it does not complete an initial transaction.

Required fields are in bold.

| Field | Description | Character Limit |

|---|---|---|

| Card Holder | The customer's name as it appears on the card. | 60 |

| Card Number | The 13-16 digit number as it appears on the card (enter without dashes or spaces between numbers). | 19 |

| Expiration | The date on which card is set to expire (enter in MMYY format). | 5 |

| Authorization Amount | The total amount you want to authorize on the customer's debit/credit card. | 15 |

| Invoice # | The merchant assigned tracking number for recording purposes. | 10 |

| Description | A brief description of goods or services purchased. | 50 |

| Customer ID | The merchant assigned customer number for recording purposes (entering a number here will NOT create a new customer in the Customer Database). | 20 |

| Order ID | The merchant assigned order number for recording purposes. | 20 |

| Billing Street | The street address matching the billing address of the customer's card (used for fraud prevention purposes with AVS). | 50 |

| Billing Postal Code | The zip or postal code matching the billing address of the customer's card (used for fraud prevention purposes with AVS). | 15 |

| CVV2/CVC | The 3 digit security code located on the back of Visa and MasterCards or the 4 digit security code located on the front of American Express Cards. If the code is not visible, or is not on the card, check one of the boxes on the right. | 4 |

| Merchant Receipt | If checked, an email receipt is sent to the merchant email address entered in the field provided. Multiple email addresses may be entered if separated by commas. To select a custom receipt, click on the arrow icon on the right and select the correct receipt from the drop-down menu. | 50 |

| Customer Receipt | If checked, an email receipt is sent to the customer email address entered in the field provided. Multiple email addresses may be entered if separated by commas. To select a custom receipt, click on the arrow icon on the right and select the correct receipt from the drop-down menu. | 50 |

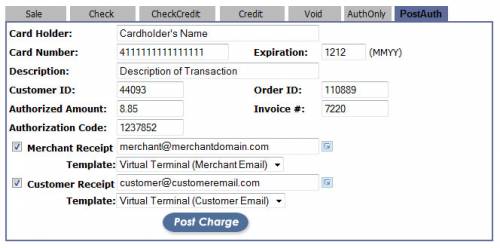

PostAuth

The PostAuth Form is used to submit offline transactions (such as voice authorizations) to your open batch for processing. ACH transactions can NOT be processed through the PostAuth form. If you do not submit voice authorization transactions into your batch, you will not be funded for them.

Please Note: Do not use PostAuth to process AuthOnly transactions. AVS and other information will not be passed to the gateway and you will be charged a higher rate by your merchant service bank.

The PostAuth form contains the following information. Once you have filled in all of the required/desired fields, click the 'Post Charge' button. One of the following transaction results will appear: Transaction Added to Current Batch(this message is essentially 'Approved' for PostAuth transactions) or Error. Click here for more information regarding transaction results.

Required fields are in bold.

| Field | Description | Number of characters |

|---|---|---|

| Card Holder | The customer's name as it appears on the card. | 60 |

| Card Number | The 13-16 digit number as it appears on the card (enter without dashes or spaces between numbers). | 19 |

| Expiration | The date on which card is set to expire (enter in MMYY format). | 5 |

| Description | A brief description of goods or services purchased. | 50 |

| Customer ID | The merchant assigned customer number for recording purposes (entering a number here will NOT create a new customer in the Customer Database). | 20 |

| Order ID | The merchant assigned order number for recording purposes. | 20 |

| Authorized Amount | The total amount you authorized on the customer's debit/credit card. | 15 |

| Invoice # | merchant assigned tracking number for recording purposes | 10 |

| Authorization Code | The authorization code - this code was provided by the customers card issuer, when you called for voice authorization. | 15 |

| Merchant Receipt | If checked, an email receipt is sent to the merchant email address entered in the field provided. Multiple email addresses may be entered if separated by commas. To select a custom receipt, click on the arrow icon on the right and select the correct receipt from the drop-down menu. | 50 |

| Customer Receipt | If checked, an email receipt is sent to the customer email address entered in the field provided. Multiple email addresses may be entered if separated by commas. To select a custom receipt, click on the arrow icon on the right and select the correct receipt from the drop-down menu. | 50 |

Rate Lookup

The RateLookup function allows you to check the current exchange rate, when converting from one currency to another.

In the example above, we have entered '25.99' in the 'Convert amount' field, and selected 'US Dollars (USD) from the first drop-down menu. To find out how much to charge for our $25.99 product in Euros, select 'Euros' from the second drop-down menu and click the 'Lookup' button. The result is displayed below the form:

25.99 US Dollars = 37.68 Euro

The console returns the equivalent amount in whatever currency you have selected based on the current exchange rate. For a complete list of accepted currencies, please click here. Once you have determined the value of your product in the new currency, you can post the amount to your web site so that international customers can easily see what your products or services cost.

Please note: The Rate Lookup form is only available to merchant accounts that have been enabled for multi-currency processing. If you would like to learn more about multi-currency processing, or add it to your merchant account, please contact your merchant service provider.

Transaction Result

When you submit a transaction, the gateway will return a result response. The three types of results are Approved, Declined, and Error. More detailed descriptions of each are below.

Approve

When a transaction is approved, you will see a an approval screen meaning the transaction is successful. The approval screen and destination of the transaction depends on the type of transaction you processed.

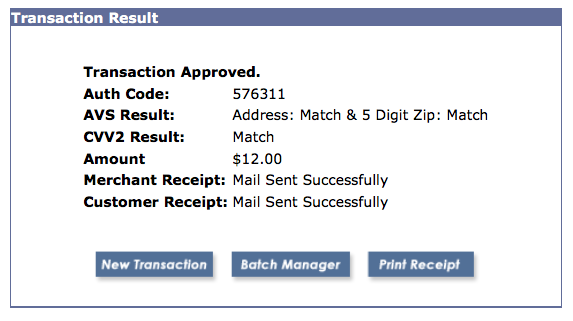

Sale & AuthOnly

Below is an example of an approved screen for credit/debit card sales and AuthOnly transactions.

It shows the following fields:

- Auth Code: The authorization code the customer's bank provided to verify the transaction was authorized.

- AVS Result: Bank response to the billing address that was submitted. For a full list of AVS responses, click here. If you do not want to accept transactions with certain responses, you may want to implement the AVS Response fraud module.

- CVV2 Result: Bank response to the cvv2 security code that was submitted. For a full list of CVV2 responses, click here. If you do not want to accept transactions with certain responses, you may want to implement the Card ID Checker fraud module.

- Amount: The amount that was authorized.

- Merchant Receipt: Reports if an email receipt was sent successfully. Only appears when you have entered an email and selected to send a merchant receipt.

- Customer Receipt: Reports if an email receipt was sent successfully. Only appears when you have entered an email and selected to send a customer receipt.

For approved transactions, emails are automatically sent to the merchant email and customer email that were entered into the respective fields (as long as the boxes were checked). Sale transactions, the transactions will be added to the current batch in the Batch Manager to await settlement. AuthOnly transactions, the transactions will be added to the Queued Transactions and will not be settled until you have posted them to the current batch. The approval screen will also show three navigation options:

- New Transaction: This button will return you to the respective tab of the vTerminal.

- Batch Manager: This button will take you to the Batch Manager tab to view this transaction in your currently open batch.

- Print Receipt: This button will open a print dialog in your browser and allow you to print a receipt for the transaction.

Credit, PostAuth, & Void

The approval screen for Credit transactions(debit/credit card refunds), PostAuth transactions, and Voids are all very simple. Each transaction type has its own respective message: 'Credit Approved Sucessfully' for credits, 'Transaction Voided' for voids, and 'Transaction Added to Current Batch' along with a reference number for postauths. The reference number given in for the postauth transaction is a gateway assigned transaction ID that can be used to locate the transaction in the gateway. The approval screen will also show three navigation options:

- New Transaction: This button will return you to the respective tab of the vTerminal to run another transaction.

- Batch Manager: This button will take you to the Batch Manager tab to view the transaction in your currently open batch.

- Print Receipt: This button will open a print dialog in your browser and allow you to print a receipt for the transaction.

Emails are automatically sent to the merchant email and customer email that were entered into the respective fields (as long as the boxes were checked) for Credit and PostAuth transactions. Emails are NOT automatically sent for Voids. Credit and PostAuth transactions will be added to the current batch in the Batch Manager to await settlement. Voids will update the status of original transaction from 'Authorized Pending Settlement' to 'Voided' and that change will be reflected in the currently open batch.

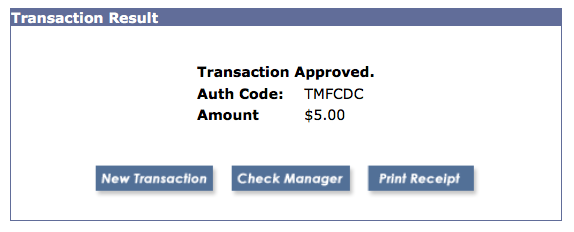

Check & CheckCredit

The approved screen for Check and CheckCredit transactions is identical. An example of the screen is shown below:

It shows the following fields:

- Auth Code: The authorization code the check processor provided to verify the transaction was accepted.

- Amount: The amount that was charged.

- Merchant Receipt: Reports if an email receipt was sent successfully. Only appears when you have entered an email and selected to send a merchant receipt.

- Customer Receipt: Reports if an email receipt was sent successfully. Only appears when you have entered an email and selected to send a customer receipt.

For approved transactions, emails are automatically sent to the merchant email and customer email that were entered into the respective fields (as long as the boxes were checked). The transactions will be added to the Check Manager to finish processing. The approval screen will also show three navigation options:

- New Transaction: This button will return you to the respective tab of the vTerminal to run another transaction.

- Check Manager: This button will take you to the Check Manager tab to view the transaction in your list of ACH transactions.

- Print Receipt: This button will open a print dialog in your browser and allow you to print a receipt for the transaction.

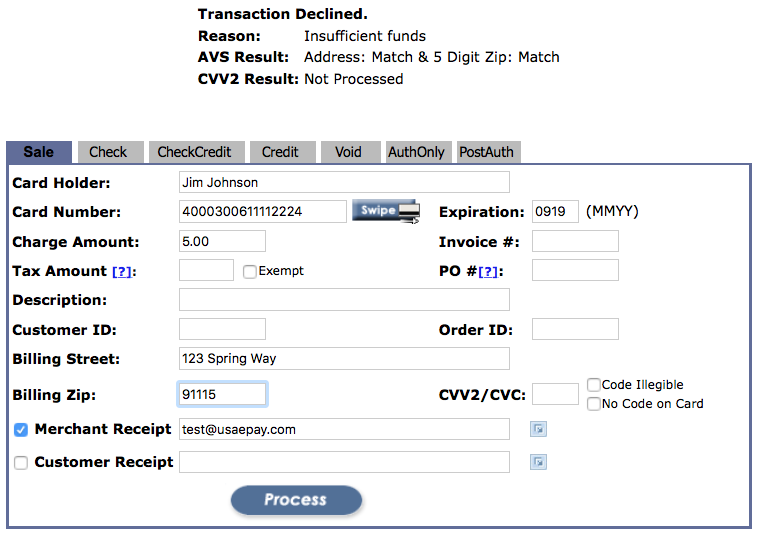

Decline

The only transaction types that will return a decline result are Sale, Check, and AuthOnly. A decline occurs when the credit card or e-check reaches the customer's bank and is declined the bank responds with a decline. The most common reason for a decline, is that the card is over its credit limit or is no longer in good standing. While transactions resulting in errors can be corrected and re-run, most declines cannot be so easily remedied. When a transaction is declined, you will not be taken to a new screen, and instead the decline message will just appear above the form as shown below:

Declined Check transactions will only show the 'Reason' field. Sale and AuthOnly transactions will show all the fields listed below:

- Reason: Explanation of why the card was declined.

- AVS Result: Bank response to the billing address that was submitted. For a full list of AVS responses, click here.

- CVV2 Result: Bank response to the cvv2 security code that was submitted. For a full list of CVV2 responses, click here.

Unless the 'Reason' field specifically states that the transaction was declined due to CVV2 error or incorrect address, then these responses did NOT cause the decline and the bank would have declined the card regardless of the response. Click here for a complete list of error and decline codes.

When a transaction receives a decline response, you have two options: 1) Have the customer call their bank to inquire into why the card was declined, or 2) request another form of payment. If they decide to provide a different card then you can just update the necessary fields and click 'Process' to submit the new payment.

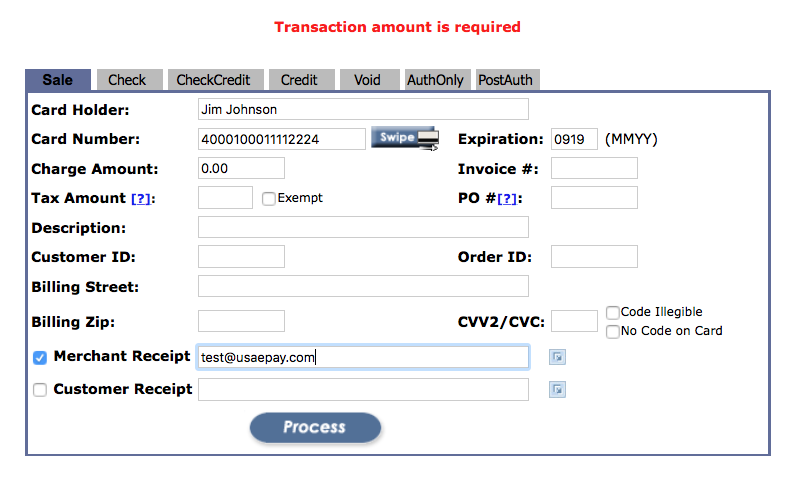

Error

All transaction types can return the result 'Error'. Errors usually indicate that there was something wrong with the transaction, but in almost all cases, the customer's bank was NOT the one who rejected the transaction. When a transaction result is 'Error', you will not be taken to a new screen. Instead, you will see an error message in red text above the form as shown in the picture below:

The message in red text is the reason for the error. There are many many reasons that a transaction may result in an error, to name just a few: a required field was left blank, a fraud module blocked a transaction to prevent fraudulent activity, the card number entered was not between 13-16 digits, the information on your VAR sheet was updated but was not updated in the gateway, authorization code entered when processing a void did not match the original transaction, or an open credit was attempted when your merchant bank settings will not allow that. In all of these cases there is a way to correct the error and re-process the transaction.

Click here for a complete list of error and decline codes. If you have questions about how to resolve an error or about why you are receiving a certain error then call our Customer Support team at 866-872-3729 ext 490 and we would be happy to assist.